How The World Coffee Market Has Affected The Cost Of My Cup Of Coffee

Most of us like things to remain the same. When we find a particular thing that we really like; such as a bag of coffee, a particular chocolate, or a bottle of wine. It could be an affordable luxury or it could be a foundation stone of your business that you rely on. I am old enough to remember the 7p Mars Bar and the shock when our local Porsche garage put petrol up to £1 a gallon, to put most people off buying it. I have never owned one for the record.

Many of us have woken up to the fact that global coffee and cocoa prices have risen to unbelievable highs in recent months. I have been wanting to try and effectively communicate how and why this should affect you too. I have said sorry enough times now, so I am going to spit it out.

The current market spikes started for three reasons.

- The obvious one is climate change. It is real! There has been a drought in the two biggest coffee-producing countries on the planet. Low rainfall affects yields and future flowering and setting of the following year’s harvest. Producers can get a feel for what next year will look like when they start this harvest.

- The biggest producing countries supply bulk commodity coffees that go to almost every big brand of coffee and the smaller guys like us buy from smaller farms and pay more. There is high demand. More people are drinking coffee than ever before and there is no surplus.

- Hedging. No, not the blackthorn and dog rose, but buying stocks ahead that you are never going to use, but to maintain your position. Some traders and big businesses will trade in coffee that they never see. When a contract matures a trader can sell and run, by liquidating the value of the market gain and this was one of the fuels to feed the market fire. This mechanism is useful for big business to maintain their costs over a period of time. 40% of all coffee traded is never seen as a physical entity. Pensions, traders and speculators are often the beneficiaries of the price spikes, and it is just numbers and money to them.

This commotion is affecting the cheapest, most ordinary coffee in the world.

That shouldn’t affect me, right?

This is where I should write sorry again. Wrong. When coffee is more scarce and world prices are high, it has a domino effect. When the base price doubles, everything else goes up too. As an example, we paid 120,000 for a container of fine cup Brazils a year ago and today it is approximately 240,000. Many of our customers have got used to the fact that our blends have increased by £2 in 12 years and couldn’t accept that we should increase our prices. As an aside, we all know how much everything else has increased. Gas and electricity, both between 400 and 600% and labour is up there too. I don’t think our customers would welcome an annual increase to match inflation, as mobile phone companies and others do.

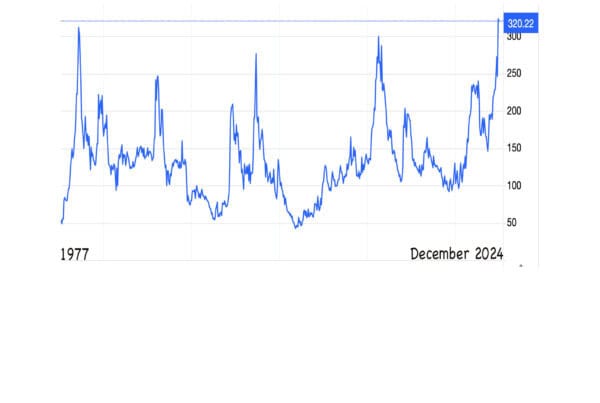

The majority of the coffee industry is hanging on, waiting to see what the next steps are. Some relationship-based importers have ripped up the commodity price rules and made lasting, long-term deals with producers that work for all parties. Many of the sources I observe feel that the highs of $4.45 were temporary and that the current $3.80/lb is the new baseline. Personally I disagree. I am of the opinion that we are in uncertain times, and if more giants commit to vast purchases at higher rates, there will be more runs on the market, and many coffees will continue to increase in cost. Let’s hope I am wrong!

Our producers have been subjected to labour shortages and wage increases of 40% or more, depending on where they are. As we came out of Covid, fertilisers increased by hundreds of percent, whilst the markets lay dormant. This story feels like it is one of three parts, where the producer, processor and end-user take turns absorbing costs on the journey of a cup of coffee.

One of the ways that we have controlled our costs has been by reinvesting over the last 26 years. Using savings to buy/ invest in our and your coffee has reduced finance charges with the bank over the years. A flexible finance loan with a trader on a container would add 2% per month. That would be 4,800 per month or 25p a kilo green and 30p roasted. What is 30p on a kilo of coffee I hear you ask? It is yet another addition. This is either to be added to the customers’ tab or another thing that has to be absorbed. We just feel that these are ways that we can insulate our customers from unnecessary coffee inflation, caused by us. Remember the 7p Mars Bar, I wasn’t joking. The Mars Bar used to be an indicator of inflation. How much is one now?

The good, no let’s go big and say the great news is that coffee goes a long way and is still somewhere between very cheap and good value as foodstuffs go. As business models for both producers and processors, it has always been an economy of scale to a degree. Producing more volume is much easier and cost-effective than processing tiny lots, as this is labour-intensive and also highly wasteful/ expensive if you have a range and are good at it.

There are many factors in coffee buying for home users and businesses. Value, price and familiarity all play their parts.

To answer my original question, your cup of coffee has increased a little, but what hasn’t? I am far from an economist but I feel we are experiencing higher inflation than the official figures of 2% because it is in everything all of the time now. I have spent half my life in coffee and prices haven’t increased significantly in that time.

Did this help you understand a little more about how the cost of your cup of coffee went up? I hope it did. Coffee is such a wonderful “thing” (industry if you prefer) and a way of life and fuel to others.